When a developer puts up two townhomes on a single lot in the Sand Section, one is always the superior unit. Let's call that the "A" unit.

The "A" unit will have the better views, and/or the least exposure to traffic noise.

The "B" unit might not have any views at all, or just inferior views, and may face greater traffic impacts.

Naturally, the "A" unit is going to sell for more once the project closes out, and the "B" unit for less.

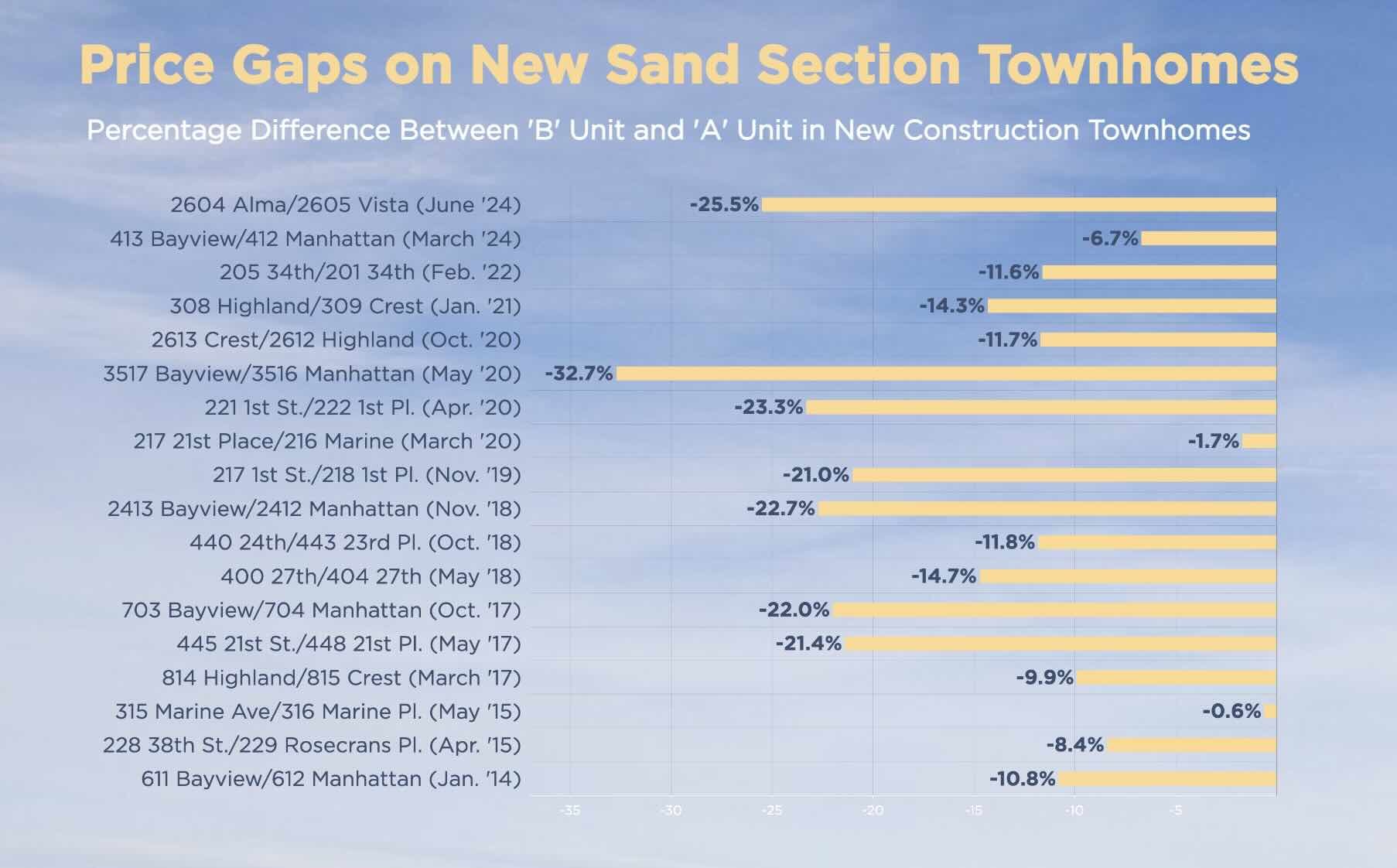

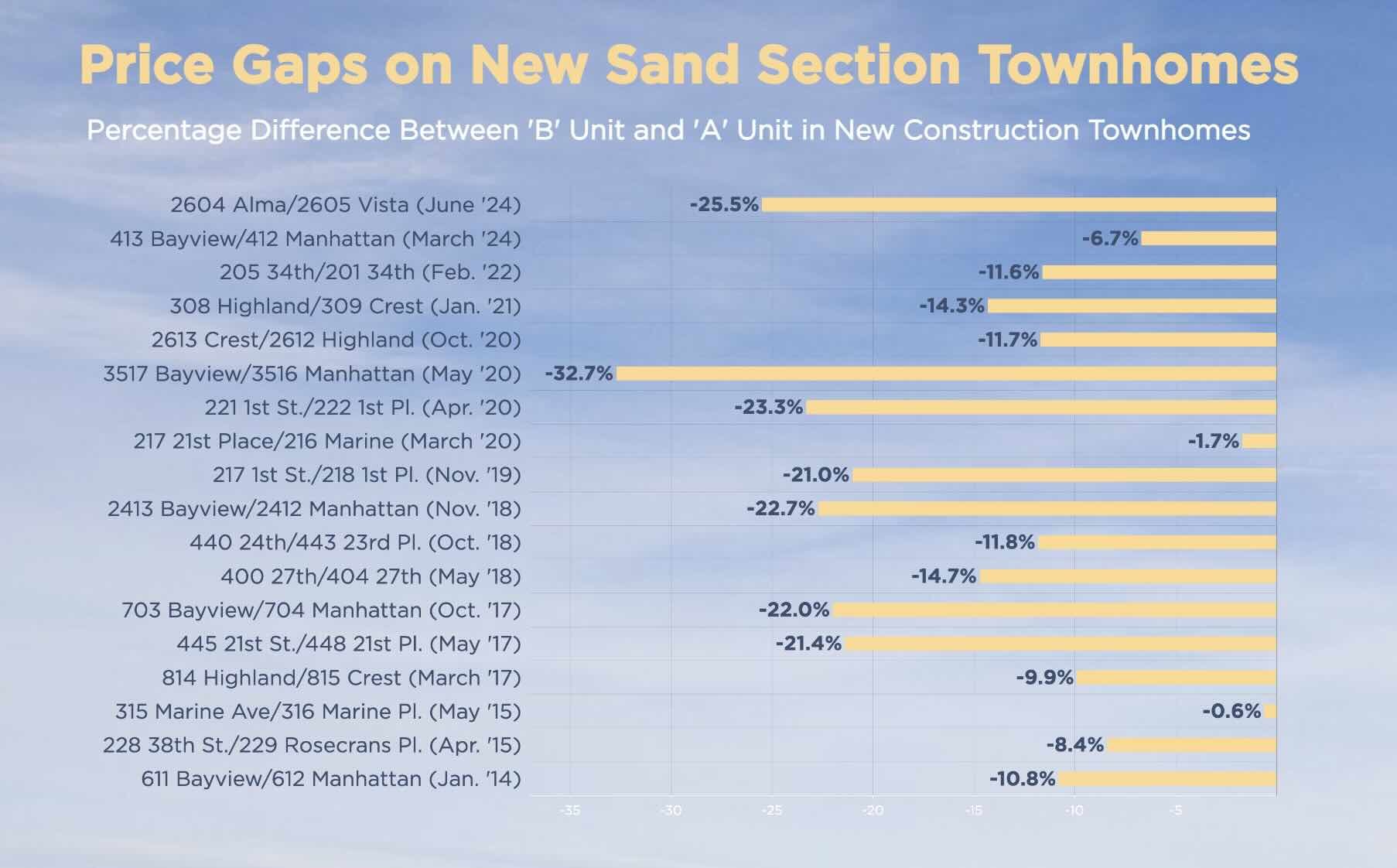

How much less? We once observed (in a post) that the typical gap is between 10-20%. (We're sharing more data here today, including that chart at the top.)

We were prompted to take a look at the A/B price gap on occasion of a newly closed sale at 2605 Vista (4br/4ba, 2678 sqft.).

We were prompted to take a look at the A/B price gap on occasion of a newly closed sale at 2605 Vista (4br/4ba, 2678 sqft.).

The home is the "B" unit of a two-townhome set, rather obviously so because it's on the rear, alley side of the lot, while the "A" unit fronts Alma and enjoys those big ocean views that can be special treats for Alma properties.

The "A" unit, 2604 Alma (4br/4ba, 2601 sqft.) hit the market in August 2022 – almost 2 years ago – and sold within a couple of weeks for $5.100M.

Meantime, 2605 Vista, with the same basic materials and comparable floorplan, just couldn't get traction. It was listed in 2022 and 2023, at prices ranging from $4.699M down to $4.150M. They had a couple deals that flamed out in '23.

This year's first listing was at $4.150M, with a cut to $3.999M in April.

It has now finally closed for $3.800M.

That's a remarkable $1.300M difference in price for the "B" unit from the (long ago) sale at the "A" unit. It's a drop of 25.5% from A to B.

What Are Typical Price Gaps for New Townhomes?

In our chart up at the top of the post, we looked back at this set and 17 additional pairs of sales of newly built "A" and "B" townhomes, going back 10 years. The idea was to see how common a 25% gap has been between values for an "A" versus a "B."

(Spoiler: It was not common.)

We did find 6 A/B price gaps of 20% or more.

The highest – 32.7% – notably occurred in a case where the "A" unit pre-sold (off market) while the "B" unit did have market exposure. (Did the off-market purchaser of the "A" overpay? Discuss.) Most of the cases we're looking at saw both units sell on the public market.

Among those all-public sales, a 25.5% price difference between the "A" and "B" unit is the greatest gap we saw, so we're calling that a record gap – in context.

Length of Time Between 'A' and 'B' Sales

For 2604 Alma/2605 Vista, there was also an uncommonly long period of time between sales.

The "A" unit of a townhome set virtually always sells first, with the "B" close behind, perhaps 2-6 months later. See our chart below.

Here, you can see that 2605 Vista has closed 22 months after its "A." There is basically no precedent for that over the past 10 years, with 9 months being the greatest gap.

(Side note: Dave's clients bought 815 Crest, the "B" unit of the pair, back in March 2017. We thought we got a pretty nifty deal due to the length of time that unit had sat on the market. 9 months was the high till now!)

Surely it's no coincidence that 2605 Alma wound up with the largest public-market gap in price after such a long period of market exposure. One might argue that market conditions and prices have changed since Summer 2022 (ya think?), meaning here that time really did cost money. And we're not even considering the seller's extra carrying costs while 2605 Vista continued to go unsold.

On-Market Today: 'B' Unit with Lesser Gap

On the market now, 413 21st Place (3br/4ba, 2085 sqft.) is the "B" unit of a two-townhome set that's still on the market.

On the market now, 413 21st Place (3br/4ba, 2085 sqft.) is the "B" unit of a two-townhome set that's still on the market.

Now in its 8th month on market, the new construction unit with some views/peeks to the south is down $296K from $3.795M to now asking $3.499M.

(413 21st Place is listed by Matt Waxman, Palm Realty Boutique, Inc.)

Its "A" twin was 412 Marine (3br/4ba, 1961 sqft.), with good views from the front, benefiting from the width of Marine Ave.

412 Marine got $3.925M in January.

413 21st Place is now listed just 11% behind that closed price, with 5 full months elapsed since the "A" unit's sale. We'll need to see what buyers ultimately do before we can place it on the range. At the moment, it's looking pretty typical, and due for a deal.

Please see our blog disclaimer.

Listings presented above are supplied via the MLS and are brokered by a variety of agents and firms, not Dave Fratello or Edge Real Estate Agency, unless so stated with the listing. Images and links to properties above lead to a full MLS display of information, including home details, lot size, all photos, and listing broker and agent information and contact information.